Can a mental health condition really qualify you for short term disability? Surprisingly, more and more people are navigating this very dilemma as mental health issues become increasingly recognized in the workplace. The conversation around this topic has shifted dramatically over the past decade, with evolving perspectives and policies.

A notable statistic to consider is that nearly 40% of American employers now acknowledge mental health disorders within their short term disability plans. This inclusion reflects a growing understanding of mental health as a legitimate reason for disability leave. Historically, mental health was often overlooked in disability policies, but recent changes indicate a more inclusive approach that could provide essential support for those in need.

The Evolving Understanding of Mental Health

Historical Perspectives

Years ago, mental health was often misunderstood. People with mental health issues were labeled as “crazy” or “weak.” These misconceptions created a stigma that still exists today but is slowly breaking down.

Back then, there was little understanding of depression, anxiety, or other mental illnesses. Society largely ignored or dismissed these conditions. Thankfully, this approach is changing.

Over time, research has shed light on how mental health affects our lives. Scientists and doctors have worked hard to understand these complex conditions. This progress has brought about significant changes in how mental health is viewed.

Modern Recognition

Today, mental health is recognized as essential to overall well-being. Schools, workplaces, and communities now talk openly about mental health. This open dialogue helps reduce the stigma associated with these issues.

Governments and health organizations around the world promote mental health awareness. Campaigns like Mental Health Awareness Month aim to educate and inform. These efforts encourage people to seek help when they need it.

Mental health is now seen as a crucial part of life. This recognition is a big step forward but, there is still work to be done. Continued education and awareness are key to further progress.

Changes in Policy and Law

Various laws have been enacted to protect and support people with mental health issues. For example, the Mental Health Parity Act requires insurance companies to cover mental health equally to physical health. This helps ensure people get the care they need.

Workplaces are also changing their policies to better support employees. Many companies now offer mental health days and provide access to counseling. These initiatives promote a healthier work environment.

These policy changes have a profound impact. They help create a society where mental health is taken seriously. As a result, more people feel empowered to seek help.

The Role of Technology

Technology also plays a significant role in advancing mental health understanding. Apps and online platforms offer resources for managing mental health. They provide accessibility to tools and support from anywhere.

Telehealth services allow people to consult with therapists and doctors online. This option became especially important during the COVID-19 pandemic. It made mental health services accessible to more people.

Emerging technologies continue to revolutionize mental health care. Innovations like virtual reality therapy and AI-driven mental health apps are on the horizon. These tools can make mental health care more effective and accessible.

Short Term Disability Explained

Short-term disability insurance provides income replacement for a limited time if you can’t work due to illness or injury. It’s essential as it helps cover your bills and living expenses during recovery. Most plans cover a few months to a year.

This insurance is typically offered through employers. Employees may need to meet certain conditions to qualify, such as a medical diagnosis from a doctor. The process often requires documentation to start receiving benefits.

Because it covers a short period, it is different from long-term disability insurance. Long-term plans are for chronic conditions that prevent you from working for more extended periods. Understanding the specifics of your policy is crucial for making informed decisions.

Policies vary, but they usually cover injuries and illnesses that prevent you from performing your job. Workers’ compensation typically covers work-related injuries separately. Knowing what your policy covers can save you time and stress during difficult situations.

Eligibility Requirements

Different employers have other eligibility criteria for short-term disability. Factors like length of employment and full-time status can impact your eligibility. Some employers offer it automatically, while others may require enrollment.

Medical documentation is a common requirement. You’ll need proof from a healthcare provider. This documentation should detail your condition and its impact on your ability to work.

Certain conditions are usually covered, like surgery recovery or severe illness. However, pre-existing conditions might not be. Check your specific policy to understand the eligibility details fully.

Application Process

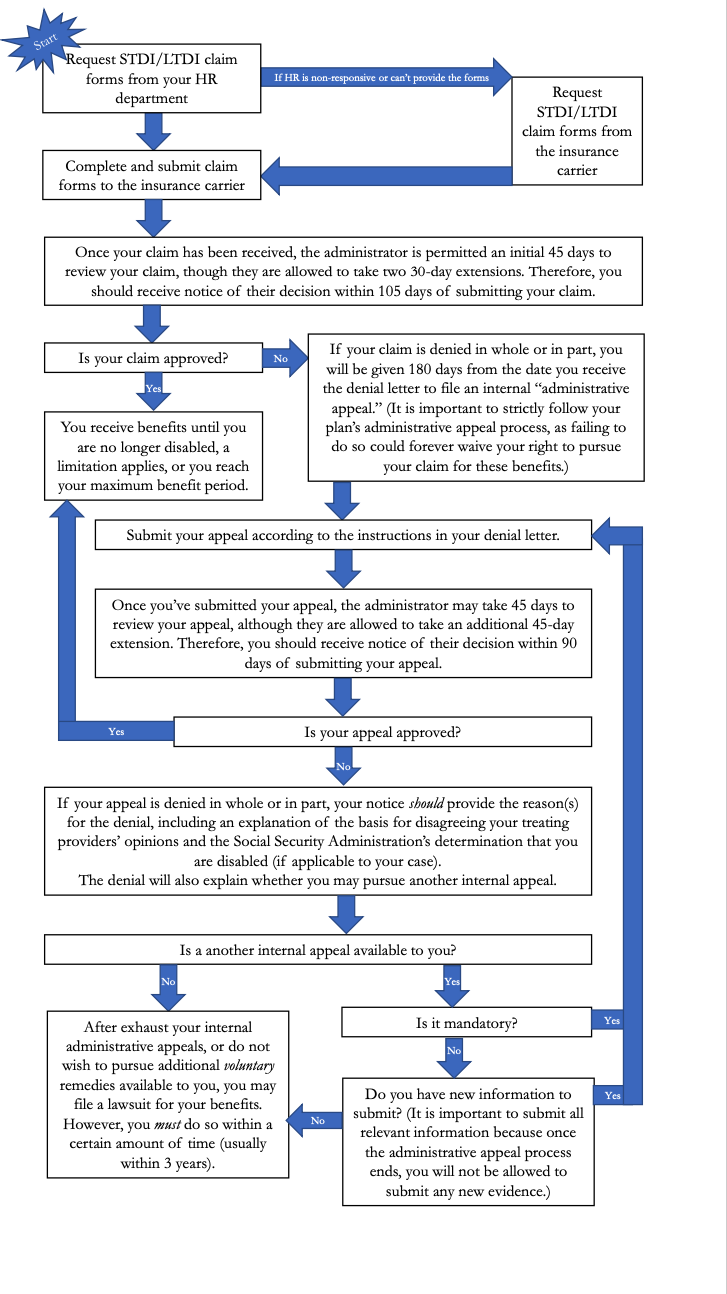

The application process for short-term disability involves several steps. First, inform your employer about your need for leave. Then, submit the necessary paperwork to your insurance provider.

This paperwork often includes forms for you and your healthcare provider to fill out. Accuracy in these forms is crucial for quick approval. Timeliness is also essential, as delays can affect the start of your benefits.

After submission, you’ll wait for approval. Insurance providers usually take some time to review your case. During this period, staying in communication with them can help expedite the process.

Benefits and Limitations

Short-term disability benefits typically cover a percentage of your salary. This percentage can range from 50% to 70% depending on your policy. These benefits help maintain financial stability while you recover.

However, limitations exist. Some policies have waiting periods before benefits start. Also, the benefit period is generally short, lasting a few months to a year.

Understanding these benefits and limitations is crucial. Policies are not one-size-fits-all, so reading the fine print is essential. Being informed can help you maximize your benefits when needed.

The Intersection of Short Term Disability and Mental Health

Mental health issues can be as debilitating as physical ailments. Conditions like depression and anxiety can make it impossible to perform daily tasks. Short term disability insurance often covers these mental health conditions, helping people get the time they need to recover.

Employers are increasingly recognizing the importance of mental health in their short-term disability plans. Many companies now include mental health as a valid reason for leave. This change reflects a growing awareness of how crucial mental well-being is for overall health.

To qualify for short-term disability due to mental health issues, you usually need a diagnosis from a medical professional. This diagnosis must detail your condition and how it impacts your ability to work. Proper documentation is key to getting your benefits approved.

The approval process can involve several steps. After submitting your diagnosis, you may need to provide additional information or undergo further evaluation. The goal is to ensure that you receive the appropriate support for your mental health needs.

Employers’ Approaches to Mental Health and Short Term Disability

Many employers are now taking a proactive approach to mental health. They understand that mental well-being is crucial for a productive workforce. This shift has led to more comprehensive short-term disability plans that include mental health coverage.

Some companies offer Employee Assistance Programs (EAPs). These programs provide counseling and mental health resources. EAPs are designed to help employees manage stress and other mental health issues before they escalate.

Flexible work arrangements are also becoming more common. Allowing employees to work from home or adjust their schedules can significantly reduce stress. Such flexibility can make a big difference in maintaining mental health.

Training and education are other key components. Many employers now offer mental health training for managers and staff. This training helps create a supportive and understanding workplace culture.

Additionally, open communication about mental health is encouraged. Companies promote a stigma-free environment where employees feel comfortable discussing their mental health needs. This open dialogue fosters a healthier and more supportive workplace.

Financial support through short-term disability can ease the burden during difficult times. Employers recognize that providing this support is essential. By doing so, they help ensure their workforce remains strong and healthy.

Future Implications for Short Term Disability and Mental Health

The future for short term disability and mental health looks promising. With growing awareness, mental health is gaining the attention it deserves. Policies are expected to become even more inclusive.

Workplaces may continue to evolve, offering more support for mental health. Companies are likely to expand their mental health programs. This could include better access to counseling and mental health days.

Technological advancements will play a critical role. Telehealth services are likely to grow, making mental health support more accessible. Apps and digital platforms will provide valuable tools for managing mental well-being.

Legislation will also adapt to meet new needs. Governments may introduce more laws to protect mental health in the workplace. These laws could ensure that mental health is treated with the same seriousness as physical health.

Employees will benefit from these changes. Greater support and understanding can lead to a healthier, more productive workforce. Enhanced policies will help reduce stigma and encourage more people to seek help.

Research in mental health will continue to advance. New findings can inform better practices and treatments. This research will strengthen the foundation for future mental health initiatives.

Key Takeaways

- Short term disability often covers mental health issues like depression and anxiety.

- Medical documentation is usually required to qualify for mental health coverage.

- This insurance helps those unable to work due to mental health problems.

- Policies vary, so it’s essential to check specific coverage details.

- The goal is to provide financial support during recovery periods.

Frequently Asked Questions

Understanding short-term disability and mental health can be complex. Here are some common questions to help clarify important points.

1. What mental health conditions are typically covered by short term disability?

Mental health conditions commonly covered include depression, anxiety, and bipolar disorder. Coverage depends on how severely these conditions impact your ability to work.

Each insurance policy might have different criteria for what constitutes a covered condition. It’s crucial to check your specific policy details for exact information.

2. How do I apply for short term disability due to a mental health issue?

The first step is usually to inform your employer about your situation. You’ll then need to submit medical documentation from a healthcare provider detailing your condition.

This paperwork helps the insurance company understand your inability to work. Timely submission of all required forms can speed up the approval process.

3. Are there waiting periods before benefits start?

Yes, most short-term disability policies have waiting periods, often ranging from 7 to 14 days. During this time, you won’t receive benefits but must financially manage on your own.

The intention of this period is to ensure that only those who genuinely need the leave apply for it. Check with your employer or insurance provider for the specifics of this waiting period.

4. Can pre-existing mental health conditions affect my eligibility?

Pre-existing conditions might impact your eligibility depending on the specific policy terms. Some policies exclude coverage for conditions diagnosed before the insurance started.

If you had treatment for a mental health issue before obtaining insurance, it’s essential to understand how that history affects current claims. Always review policy fine print carefully.

5. How long can I receive benefits under short term disability for mental health?

The benefit duration varies by policy but usually ranges from three months to one year. The exact length will depend on both your condition and specific plan details.

Your healthcare provider’s assessment will also play a role in determining how long you’ll be eligible for benefits. Ensure consistent communication with both medical professionals and insurers throughout this period.

Conclusion

Understanding the interplay between short-term disability and mental health is crucial. These policies provide essential support during challenging times. As awareness grows, more inclusive policies are emerging, reflecting the importance of mental well-being.

Employers and employees alike benefit from a clear understanding of these resources. With the right coverage, individuals can focus on their recovery without the added stress of financial instability. Continuous education and supportive policies will pave the way for more resilient workplaces.